Affordability Is Improving in Massachusetts.... Here’s What That Means for You

If high prices or rising rates kept you on the sidelines, here’s some welcome news: buying a home in Massachusetts is finally becoming a bit more affordable.

Monthly payments are easing slightly, and the intense financial pressure that buyers have felt for the past few years is beginning to let up. That doesn’t mean everyone can buy tomorrow but it does mean the trend is finally turning in your favor.

What’s Changing: A Look at Affordability

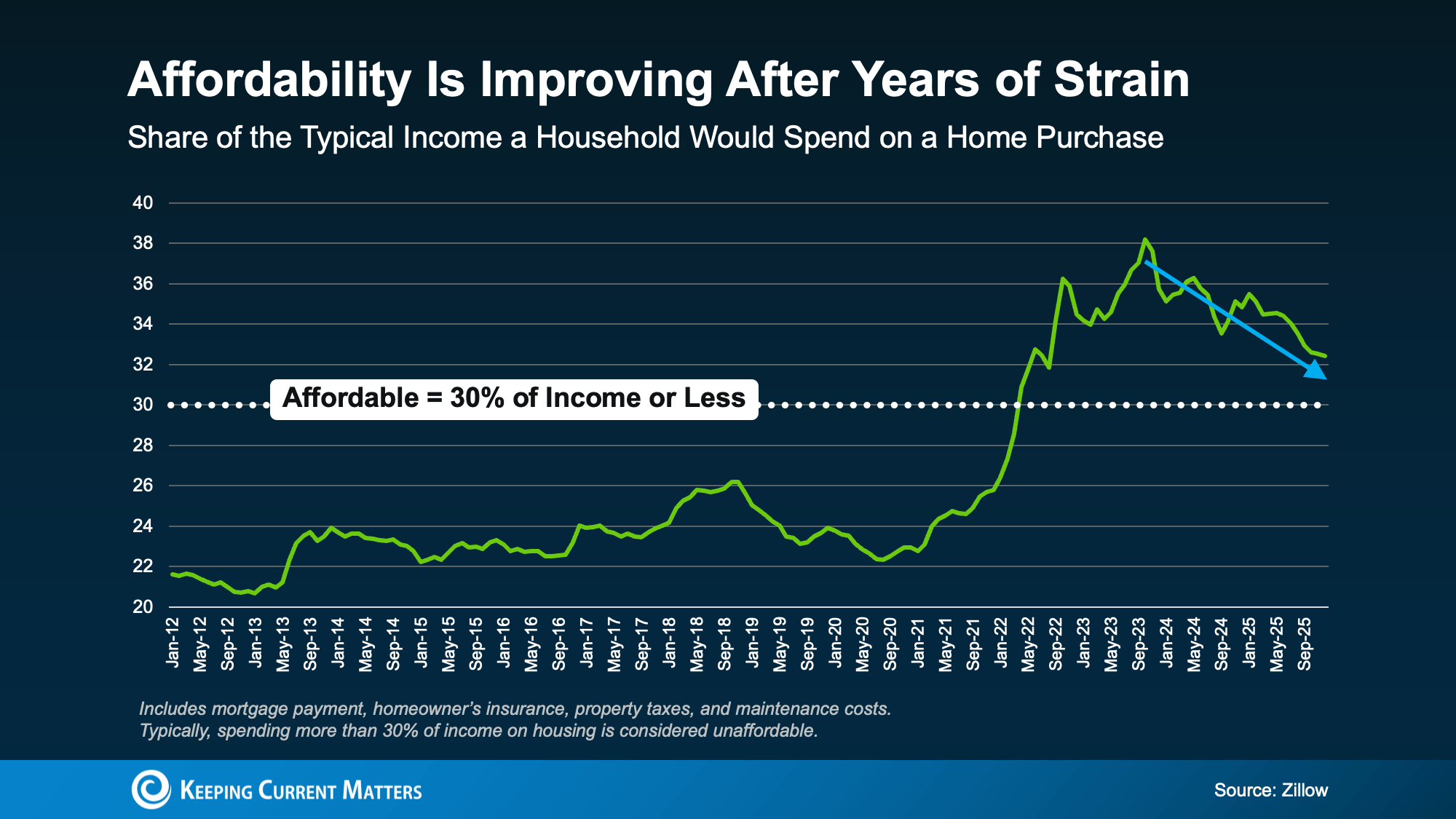

According to Zillow, housing is considered affordable when it takes 30% or less of your monthly income to cover mortgage payments, taxes, insurance, and maintenance. Over the past few years in Massachusetts, that number ballooned well beyond 30%, especially in hot markets like Worcester, Middlesex County, and the MetroWest region.

But we’re now seeing slow, steady progress. As of early 2026:

-

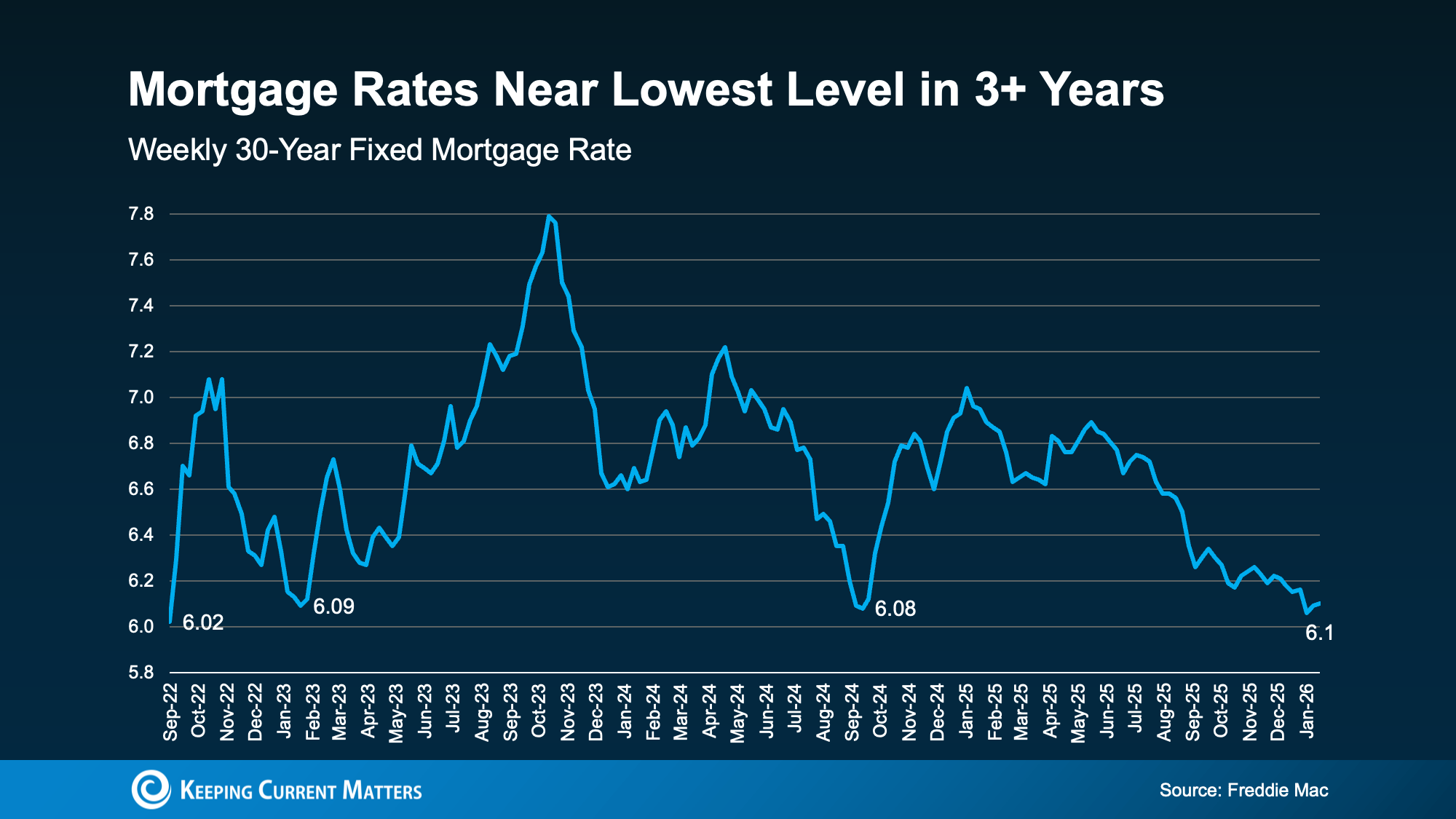

Mortgage rates have dropped to their lowest levels in over three years.

-

Price growth across MA has cooled, especially in Central MA. While prices aren’t falling, they’re rising more slowly.

-

Wages—especially in sectors like healthcare, education, and tech—are finally growing faster than home prices in many parts of the state.

Massachusetts Snapshot: What We’re Seeing Locally

Let’s break it down for some of the markets you’re likely watching:

-

Worcester County: Median home prices are holding steady near $495,000 (as of late 2025), with more homes staying on the market longer. That means less bidding war pressure and more breathing room for buyers.

-

Middlesex County: Still a pricier market overall (~$810,000 median), but many towns are seeing price growth soften—especially compared to the steep jumps in 2021–2022.

-

Buyers in towns like Auburn, Grafton, Shrewsbury, and Westborough are now seeing more options in the $400–600K range with reduced competition and better negotiating leverage.

Why It’s Getting Easier To Buy

Here’s what’s driving this shift:

-

Lower Mortgage Rates

Rates have dropped more than a full percentage point since their peak, helping lower monthly payments by hundreds of dollars—even on the same purchase price.

2. Cooling Prices

Prices are still higher than they were pre-pandemic, but they’re no longer climbing at double-digit annual rates. That makes the market more stable—and less of a moving target.

3. Income Gains Outpacing Home Prices

With stronger wage growth in Massachusetts and many dual-income households, your buying power is finally starting to catch up.

🧠 Economist Insight: “Affordability won’t snap back overnight,” says Mark Fleming of First American, “but like a ship catching a tailwind, it’s now sailing in the right direction.”

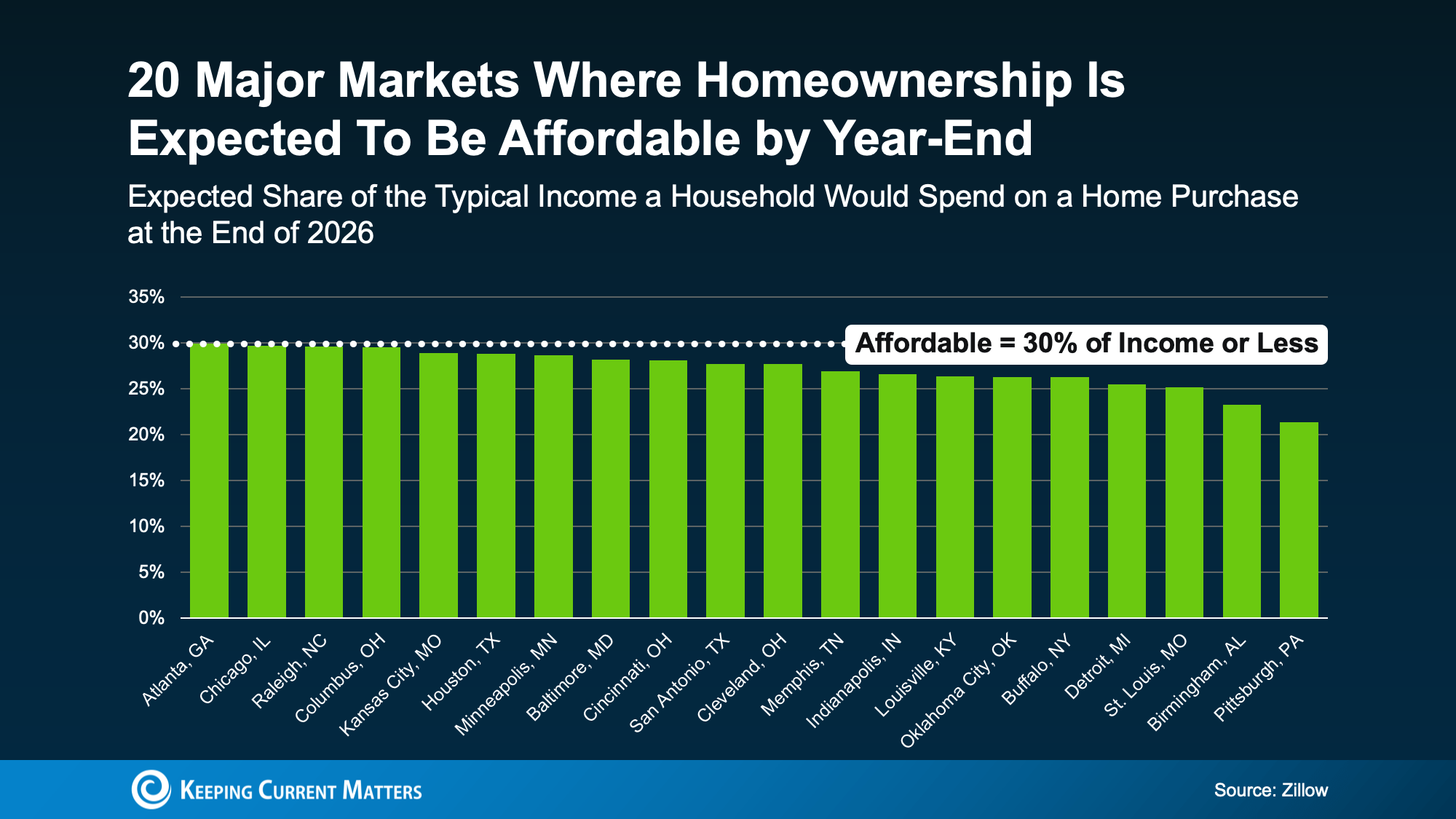

Are We Back to ‘Affordable’? Not Yet, But We’re Closer

Zillow projects that some U.S. markets will reach full affordability (below 30% of income) by the end of the year. While Massachusetts likely won’t hit that benchmark just yet, especially in high-demand areas like Boston and MetroWest, the needle is moving.

In fact, first-time buyers who were shut out in 2022 and 2023 are finally seeing real opportunities in 2026. Especially if you’re open to neighborhoods just outside the core markets—think Northbridge, Millbury, or Spencer—your monthly numbers may already be within reach.

Bottom Line

For the first time in years, buying is becoming a little more realistic in Massachusetts.

These affordability improvements aren’t happening overnight and they’re not equal in every zip code, but they are happening.

🏡 Want to know how these trends impact you? Let’s take a look at your monthly numbers and local options together.

📞 Call or text Annie Oakman, REALTOR® with Media Realty: 508-365-7036

Or grab a time to chat: Schedule a no-pressure consult here https://calendly.com/annieoakmanrealty/introcall