How can you realistically get to a 700+ credit score in just 90 days? Especially if you’re thinking about buying a home?

The short answer: by focusing on the credit factors that move the needle fastest and avoiding the common mistakes that stall progress. If you’re intentional, strategic, and consistent, meaningful improvement in 90 days is absolutely possible.

Step 1: Know Your Real Starting Point

Before you try to improve your credit score, you need clarity.

Pull your credit reports from all three bureaus and review them line by line. You’re looking for:

-

Incorrect balances

-

Accounts that don’t belong to you

-

Late payments reported inaccurately

-

Collection accounts that should’ve aged off

Disputing errors won’t magically fix everything overnight, but correcting even one inaccurate item can give your score an immediate lift, especially if you’re close to the 700 mark already.

Step 2: Pay Down Credit Card Balances (This Matters More Than You Think)

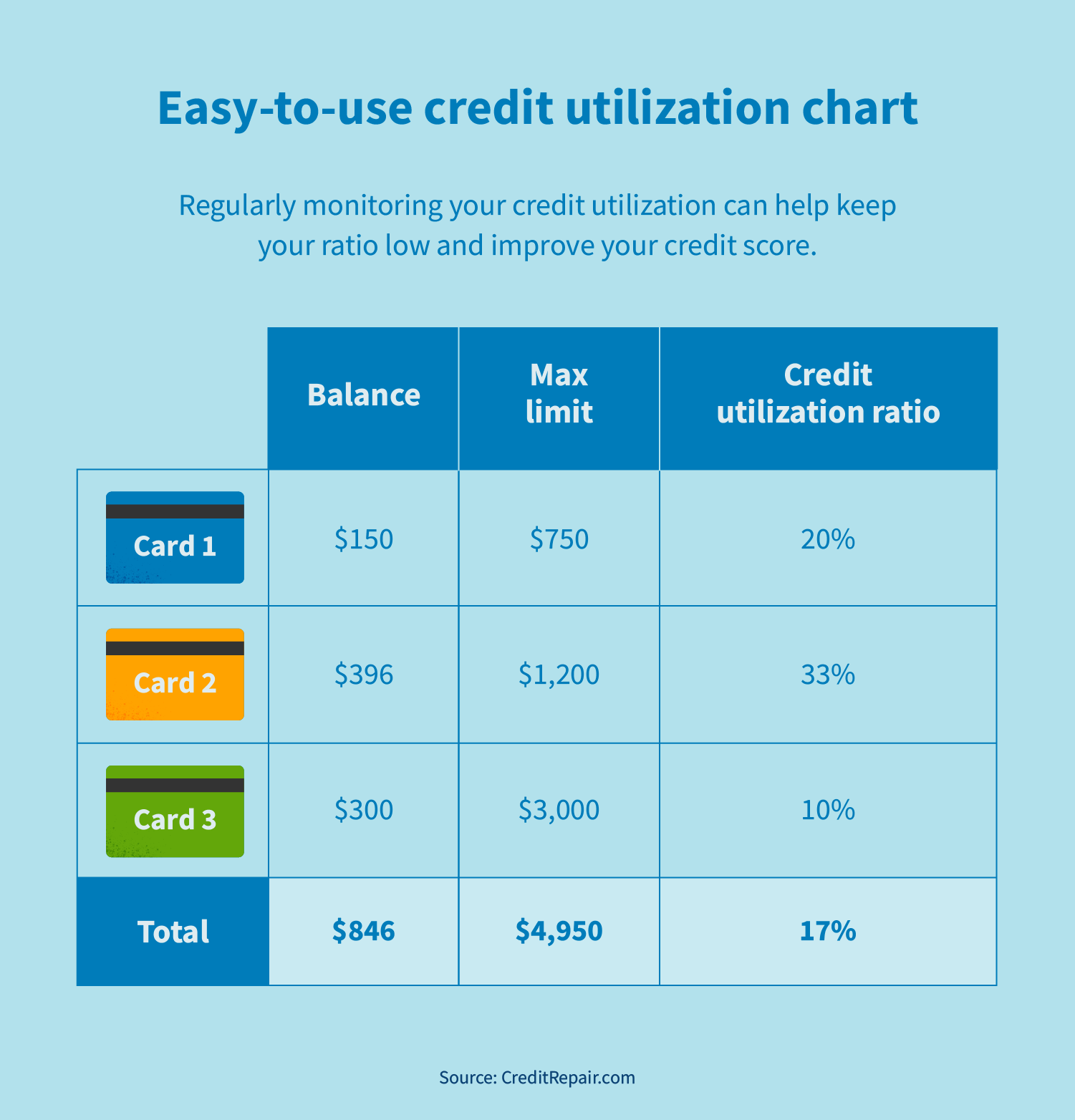

Credit utilization (how much of your available credit you’re using) is one of the fastest ways to improve your credit score.

Aim to:

-

Get every card below 30% utilization

-

Ideally target 10–20% or less

For example, if a card has a $10,000 limit, try to keep the balance under $3,000, and lower if possible. This single move alone often creates the biggest score jump within the first 30–60 days.

Step 3: Never Miss a Payment (Set It on Autopilot)

Payment history is the largest factor in your credit score.

If you’re serious about reaching a 700 credit score in 90 days:

-

Set minimum payments on autopay

-

Pay early when possible

-

Avoid skipping even one due date

One missed payment can undo weeks of progress. Consistency here protects the gains you’re making elsewhere.

Step 4: Don’t Open or Close Accounts Right Now

When you’re actively working to improve your credit:

-

Avoid opening new credit cards

-

Don’t close old accounts, even if you don’t use them

New accounts can temporarily lower your score, while closing older accounts can reduce your available credit and shorten your credit history. Stability is your friend during this 90-day window.

Step 5: Use Credit Strategically, Not Emotionally

Once balances are paid down, keep activity light and intentional:

-

Make small purchases

-

Pay them off quickly

-

Let balances report low, but not zero on every card

This shows responsible usage without increasing utilization. It’s one of the most overlooked credit tips for home buyers, especially those preparing to apply for a mortgage.

Final Takeaway

If you’re wondering how to get a 700 credit score quickly, the answer isn’t gimmicks or shortcuts, it’s focus. Paying down balances, protecting your payment history, and avoiding unnecessary changes can dramatically improve your credit score before buying a home.

And if homeownership is part of your plan, credit preparation is one of the smartest first steps you can take.

Ready for a No-Obligation Credit & Home-Buying Strategy Call?

If you want to understand how your credit score impacts your buying power and what steps make sense for your timeline, let’s talk.

I’m Annie Oakman, REALTOR® with Media Realty, serving Central Massachusetts, and I help buyers prepare strategically, long before they ever submit an offer.

👉 Schedule your free, informational call here:

https://calendly.com/annieoakmanrealty/introcall

There’s no pressure, just clear guidance so you can move forward confidently!